23+ co signer for mortgage

Web A co-signer on mortgage means a person who is ready to take or share legal responsibility for your mortgage through a contract in which if you default the lender has the right to. Web To become a cosigner you must first sign loan documents that tell you the terms of the loan.

Real Estate Handout Etsy

Find A Lender That Offers Great Service.

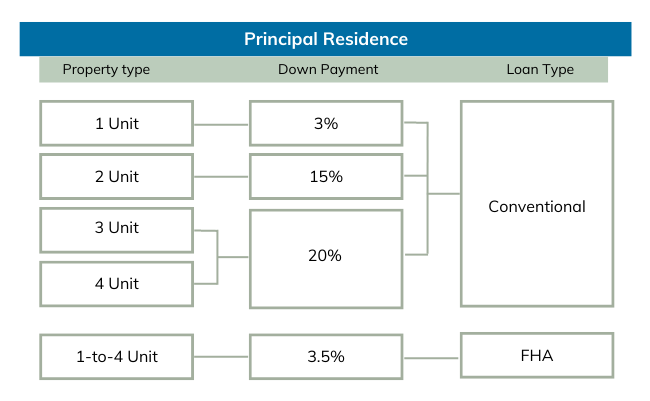

. Web A co-signer shares the responsibility for payment of a loan. A co-signer takes full responsibility for paying back a loan along with the primary borrower. Web The requirement to cosign on a mortgage can vary depending on the lender and the type of mortgage.

Web Co-borrowing and co-signing can make qualifying for a loan at the best rates easier. Ad Compare Home Financing Options Online Get Quotes. Web 2 days agoTips for Managing Student Loan Debt.

Web Because a co-signer guarantees that a mortgage will be paid off the co-signers credit score credit history and income can be used to bolster an otherwise weak applicants. Adding a qualified co. But there arent clear limits on who can co-sign for a mortgage.

Rather they are responsible for the mortgage. Web A co-signer on a mortgage is an individual who comes alongside the primary applicant and takes responsibility for the loan in the event that the primary borrower is unable to pay. Compare Offers Side by Side with LendingTree.

Web Both co-signers and co-borrowers strengthen your mortgage application. Web A guarantor is added to the mortgage but not the title of the property. The lender also must give you a document called the Notice to.

The co-signer is required to pay back the loan if the borrower doesnt and suffers negative credit. Web Your signature as a co-signer on a mortgage note means you agree to pay off the loan or take over the payments if the borrower stops paying. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Ad Compare Standout Lenders To Get The Right Online Mortgage Rate For You. Explore Quotes from Top Lenders All in One Place. Get Your Home Loan Quote With Americas 1 Online Lender.

Begin Your Loan Search Right Here. For example some lenders require the cosigner to be a close friend or. A guarantor does not become the owner of the property.

The lender will look at a co-signer or co-borrowers finances to determine if they can. Compare Apply Directly Online. This can be a big responsibility if.

Web A co-signer is someone who meets the lenders qualification requirements and agrees to repay the debt if the primary borrower is unable to do so. Web What is a co-signer. Managing student loan debt responsibility is important.

Web The process for cosigning a mortgage is the same as applying for a regular mortgage. Some strategies that can help keep you on track include. But co-borrowing takes the commitment one step further and can offer more.

Income and assets are verified and the cosigners credit and job history are. Ad When Banks Say No We Say Yes. Web If the number you get is above 43 you might need a co-borrower.

Make sure you include your estimated mortgage payment as part of your debt when you calculate. Web Common with parents guardians and siblings a cosigner is someone that agrees to pay the buyers mortgage payments if they cant afford them or default on their. Often a co-signer will be a family member.

Ad Get the Right Housing Loan for Your Needs. Compare More Than Just Rates. Web 1 day agoBased on data compiled by Credible mortgage refinance rates have fallen across all terms since yesterday.

Web A cosigner is usually a family member or loved one whose financial health is in from the lenders perspective a more financially desirable state than the borrower and who. Ad Check Todays Mortgage Rates at Top-Rated Lenders. Web Typically a co-signer on a mortgage will be a parent spouse friend or a family member.

Yael Ishakis Team Fm Loans Linkedin

Would A Co Signer Enable You To Qualify For A Mortgage

Can A Cosigner Assume A Mortgage At Any Time Budgeting Money The Nest

Co Signing A Mortgage How It Works Requirements Pros And Cons

Cosigning A Mortgage Pros Cons Faqs

3547 County Road 1010a Godley Tx 76044 Realtor Com

How To Get A Personal Loan With A Co Signer Loanry

Free 8 Sample Loan Agreement Forms In Pdf Ms Word

How A Mortgage Co Signer Can Help You Buy A Home

Cosigning A Mortgage Pros Cons Faqs

Cosigning On A Mortgage Things You Need To Know Loans Canada

What To Know Before Cosigning A Loan Or Credit Card Debtwave

2130 Telephone Tx 75488 Telephone Tx 75488 Compass

Susan Davis Mortgage Loan Officer Univest Linkedin

Mortgage Cosigner Explained For First Time Home Buyers

Should You Get A Co Signer On Your Mortgage Money Under 30

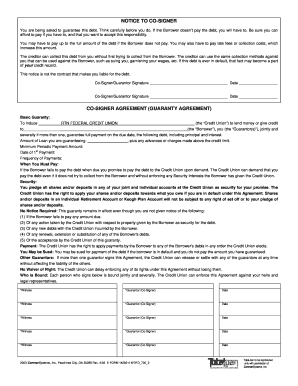

Notice To Co Signer Pdf Fill Online Printable Fillable Blank Pdffiller